What HP Sales Northeast is Doing

- We are 100% stocked up on supplies and can make an emergency delivery if you need it.

- We’re currently sending out supplies and servicing equipment as well.

- For the health and protection of our staff, we ask that you call ahead for orders and refrain from entering the building in order to make transactions seamless.

- Be sure to follow us on Social Media for updates. We also highlight our customers who are finding ways to beat this virus – find out how you can stay up and running during this time too!

- From breadings and marinades to a fully stocked parts department, we’re here for you!

Service Update: What To Know Before You Call

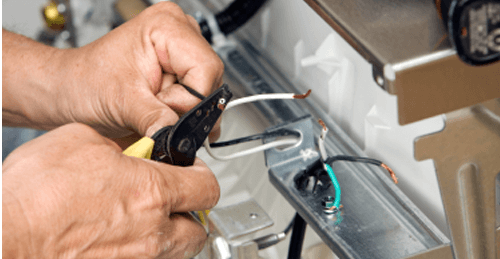

Our service technicians are taking all necessary precautions during this time. Because of this unusual situation, we are asking our customers to be willing to diagnose simple fixes over the phone or via video conferencing. We would hate to risk our technicians health and safety for a simple fix that could have been performed remotely.

Section179 Tax Deduction

We wanted to make you aware of Section 179 of the IRS tax code which allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves. At this time we urge our customers to take advantage of this great deal. That means that if you buy a piece of qualifying equipment, you can deduct the full purchase price from your gross income (up to $1,040,000.00 from your 2020 taxes). Check out the calculator to see how much you could get back today! Click here for more info.

National Restaurant Association: Updates and Resources

The National Restaurant Association Educational Foundation set up the Restaurant Employee Relief Fund to help restaurant industry employees experiencing hardship in the wake of the coronavirus disease (COVID-19) outbreak. Find out more information here.

Interested in providing support? Contact Allison Rhyne, Vice President of Development.

COVID-19: Resources for Businesses and Employees (from NAFEM)

As news on the COVID-19 virus changes hourly, here are resources we encourage you to monitor regularly for the latest updates and recommendations on safety procedures for your business and associates.

Resources

- Business

- U.S. Chamber of Commerce information and resources

- U.S. Chamber of Commerce Federal CARES Act details

- Small Business Administration (SBA) Disaster Assistance Information; Paycheck Protection Program (PPP) FAQs

- Congressional Research Service (CRS) analysis of the CARES Act SBA Loans

- CRS Report on the Defense Production Act (DPA)

- SBA Guide to Eligible Lenders

- PPP Application Form for Borrowers

- PPP Lender Application Form – FYI

- PPP FAQS – Updated 4.7

- Crisis Management Resources: Managing Through Crisis

- Datassential Research

- Datassential Coronavirus Research Report – Consumer 4.10.2020

- Datassential Coronavirus Research Report – Consumer 4.8.2020

- Datassential Coronavirus Research Report – C & U Operators 4.6.2020

- Datassential Coronavirus Research Report – Operator 4.3.2020

- Datassential Coronavirus Research Report – Consumer 4.1.2020

- Datassential Coronavirus Research Report – Healthcare Operators 3.31.2020

- Datassential Coronavirus Research Report – Consumer 3.27.2020

- Datassential Coronavirus Research Report – Consumer 3.24.2020

- Employer/Employee: U.S. Department of Labor (DOL) Resources

- Employer/Employee: Paycheck Protection Program (PPP) Resources

- U.S. Chamber of Commerce Coronavirus Loans via CARES Act

- Small Business Administration (SBA) PPP Borrower Information Fact Sheet

- SBA PPP Overview

- SBA Interim Final Rule Business Loan Program Temporary Changes; PPP

- SBA PPP FAQs (updated 4.3)

- Affiliation Rules SBA PPP (updated 4.3)

- Employer/Employee: MRA Resources/Families First Coronavirus Response Act (FFCRA) information

- MRA’s Contagious Diseases and Pandemic Toolkit

- Emergency Paid Leave Concerns courtesy of Kushner & Company

- Emergency Paid Sick Leave (EPSL) request form, courtesy of Linder & Marsack

- Emergency Family & Medical Leave (EFMLA) request form, courtesy of Linder & Marsack

- Families First Coronavirus Response Act (FFCRA) HR Checklist

- Emergency Paid Sick Leave Under FFCRA memo to employee

- Emergency Family and Medical Leave (EFMLA) Under FFCRA – Notice of Leave Eligibility

- Temporary Layoff Health Insurance Benefits

- COVID-19 Updates Webpage

- Sample FFCRA Policy

- Approval/Denial for Emergency Paid Sick Leave and Notice of Eligibility and Designation for Emergency Family and Medical Leave

- Statements from Employees Requesting Emergency Paid Sick Leave and Emergency Family and Medical Leave

- FFCRA Absence Tracking Worksheet

- Events: ASAE’s Coronavirus resource page

- Finance

- Government

- Health/CDC Resources

- Manufacturing: NAM’s Policy Plan for the Coronavirus Outbreak

- Service Agents: CFESA’s Essential Services Letter

- Taxes

- Trade

- Travel Restrictions